New Survey: Institutional Investors Believe American Democracy Is Increasingly At Risk

According to a new survey, a strong majority of institutional investors believe threats to democracy in the U.S. are rising. Less than one-third are confident public companies are equipped to manage that risk.

In This Resource

Threats to democracy in the United States also pose a risk to investors and the economy. Just this month, Fitch Ratings cited deteriorating standards of governance when it downgraded the U.S. credit rating. A report published in July argues that investors have a fiduciary duty to monitor threats to democracy and respond to them.

The States United Democracy Center, in partnership with the Brookings Institution, surveyed institutional investors about their perception of threats to democracy and how well-equipped companies are to manage that risk. We received responses from investors representing nearly $10 trillion in assets under management.

The research is part of the Capital + Constitution project, which explores the intersection between business and ongoing risks to democracy. The project’s mission is to help investors reduce those risks and protect their portfolios, particularly as we head into the 2024 presidential race.

Investors see rising political risk in the United States, but they think companies aren’t fully ready for it.

The survey defined political risk as interference with electoral processes, disruptions to orderly transitions of power, deterioration of checks and balances across branches of government, and/or the erosion of the rule of law.

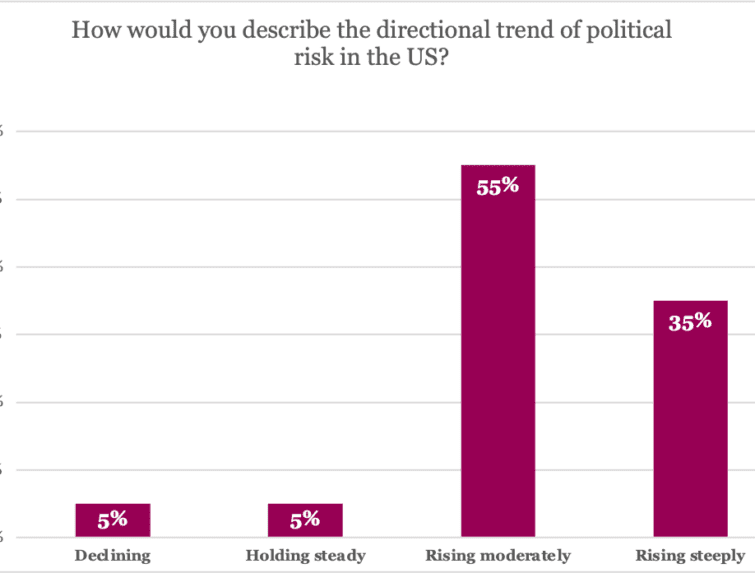

Those threats are a matter of clear and growing concern for investors, the survey found. More than 90% of big institutional investors surveyed believe threats to American democracy are rising.

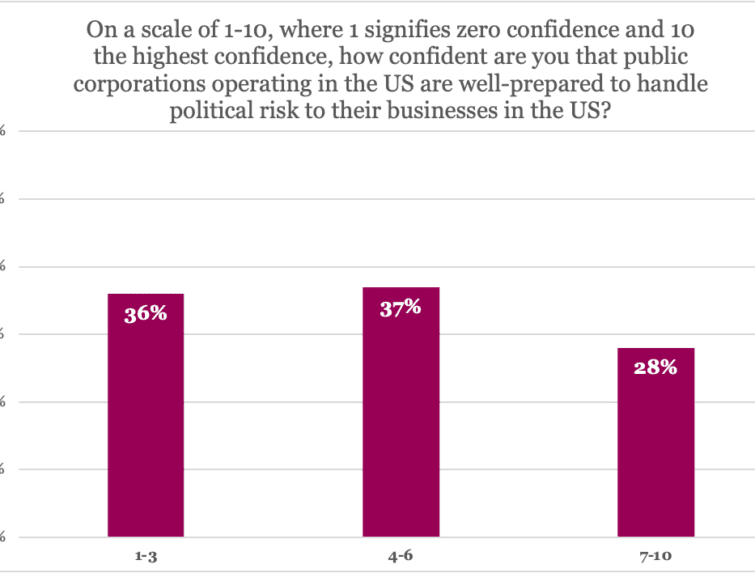

Yet less than 30% of these same investors are confident that public companies in the United States are equipped to manage that risk.

There’s a disconnect between how investors evaluate political risk inside and outside the United States.

Almost all respondents said they take political risk into account when making investment decisions focused outside the United States. But a significant percentage assume no such risks are involved inside the U.S. market. As many as 40% reported that they typically do not consider political risk at all when deciding about investments in the U.S.

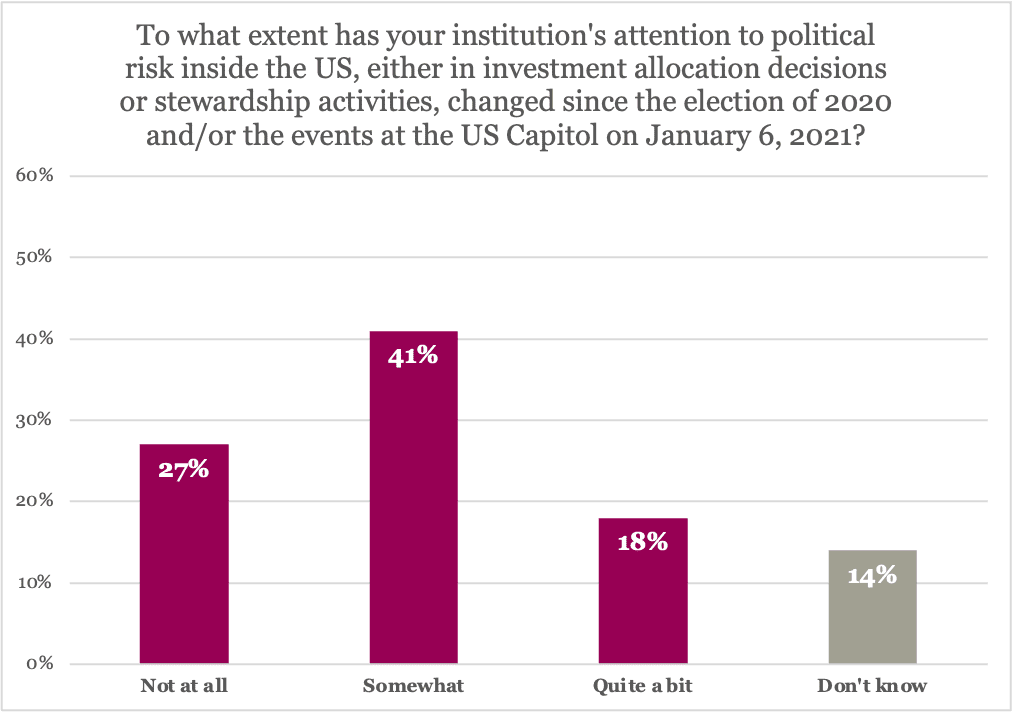

Still, nearly 60% of institutional investors said they have paid more attention to political risk in the U.S. since the Jan. 6 attack on the Capitol.

Some investors are incorporating political risks into their conversations with company boards and executives.

Survey respondents were encouraged to include examples of how they address political risks, if they do so, when engaging with companies. Key examples include:

- Making sure boards and management are aware of threats to democracy and that appropriate internal governance structures are in place for boards to effectively monitor political risk.

- Expanding the investors’ stewardship teams and more closely examining the governance, actions, and disclosure of portfolio companies’ lobbying and political spending.

- Considering voting or investment action if companies’ activities are far out of step with the investing institution’s principles.

- Focusing more intently on the headline risks of lobbying and similar expenditures and whether companies are adequately disclosing those expenditures.

- In the months following Jan. 6, identifying and alerting companies that had given money to election deniers in Congress.

Several prominent U.S. corporation CEOs have spoken out in support of nonpartisan safeguards for democracy to mitigate rising political risks. Institutional investors appear to share a similar concern that rising political risk is material to long-term value. A longer discussion of the options that investors are already choosing, or may choose, to better protect against political risks can be found in Capital + Constitution’s latest report: “The Financial and Economic Dangers of Democratic Backsliding,” by Layna Mosley, professor of politics and international affairs at Princeton University.

The C+C survey was conducted anonymously and was fielded Jan. 30 to April 21, 2023, among 22 institutional investors representing almost $10 trillion in assets under management. The results are descriptive and represent the views of these respondents only.